JPA World Tax Game - Tax Burdens and Tax Incentives on Cars

We have investigated which tax components the individual countries use to promote or burden the sale of cars. Environmental and climate protection are offset by the great economic importance of the car market for the economy.

JPA World Tax Game - Tax Burdens and Tax Incentives on Cars

We have investigated which tax components the individual countries use to promote or burden the sale of cars. Environmental and climate protection are offset by the great economic importance of the car market for the economy.

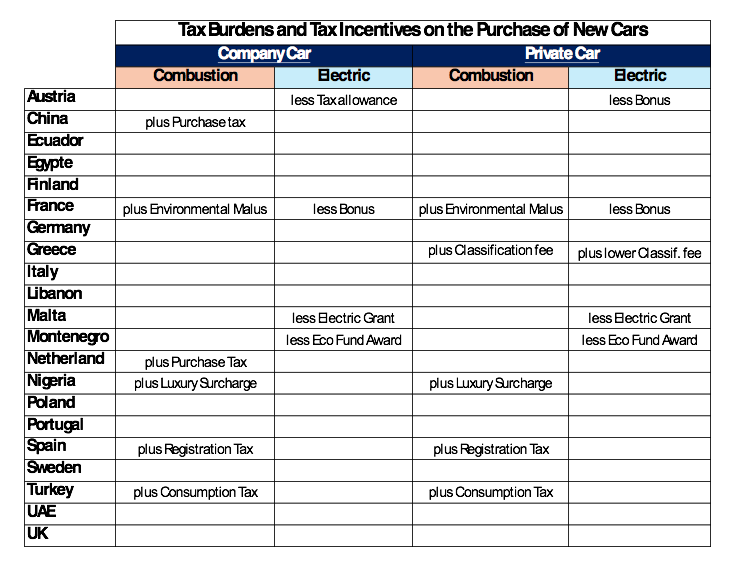

We have investigated which tax components the individual countries use to promote or burden the sale of cars. Environmental and climate protection are offset by the great economic importance of the car market for the economy. In many countries, the transition from combustion engines to electric vehicles is being used as an opportunity to impose a higher tax burden on the purchase of a new combustion engine, while promoting the purchase of an electric vehicle through premiums and tax concessions.

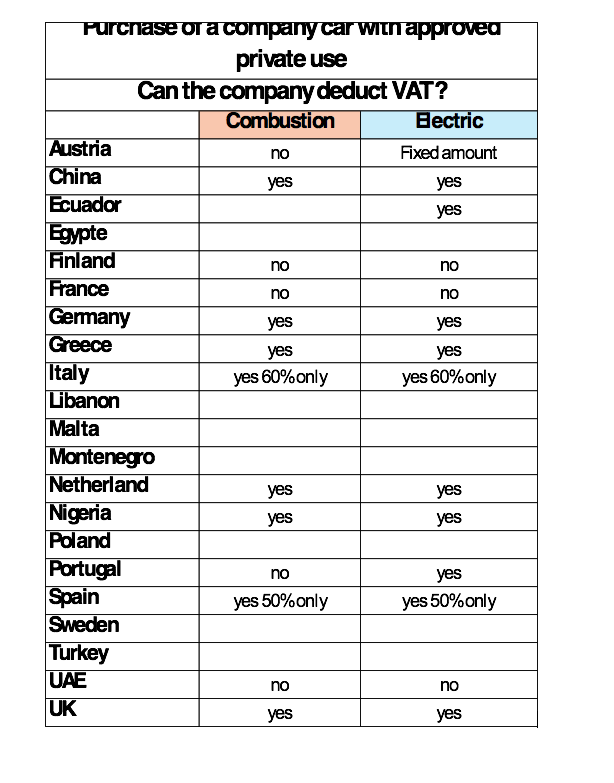

In order not to take into account the different prices of vehicles in the respective countries or price differences between combustion and electric vehicles, we have assumed a fixed list price of € 70,000, on which the dealer grants an additional € 5,000 discount. We therefore assumed a purchase price of € 65,000 (gross including VAT). It should also be compared whether there are differences if the vehicle is purchased from a company or a private individual. In the case of purchase by a company and subsequent private shared use, we asked whether the company can deduct VAT and whether income tax is payable on the private use of the company vehicle.

A total of 21 countries took part in the comparison and it emerged that in many countries, vehicles with combustion engines are largely taxed more heavily when they are purchased. In most cases, however, combustion vehicles are taxed more heavily in the annual vehicle tax according to their CO2/km emissions. In the case of electric vehicles, on the other hand, there is usually significant tax relief and often even state bonuses when purchasing.

In France, there is particularly heavy additional taxation on new purchases of combustion engines if the vehicles have higher CO2/km emissions. From a value of over 193 g/CO2/km, an environmental penalty of € 60,000 is payable in addition to the purchase price of the vehicle in 2024, which will rise to € 70,000 in 2025.